Instant Saver

We've made saving simple.

Our Instant Saver is an easy access savings account designed to help you save whenever you want with great flexibility and zero fuss. Easy payments. Instant withdrawals. Simple.

2.75% AER variable

Open a savings account with £0

Unlimited withdrawals

24/7 access to your cash from the app

What is an easy access savings account?

An easy access saving account, also known as an instant access savings account, pays interest but lets you withdraw your funds instantly when you need them, with no penalties. You can open one of our Instant Savers without a deposit.

What's the Instant Saver interest rate?

2.75% AER / 2.72% Gross variable

Like the rate? See the table below to see how much interest you could earn with your deposit.

£100

£500

£1,000

£5,000

£10,000

Instant Saver

Monthly interestGross* variable

2.72%

AER** variable

2.75%

Earns You

£2.75

per annum***

* Gross rate is the interest rate paid on an account before any taxes or other deductions are accounted for.

We will not deduct any tax from your interest. You are responsible for paying any tax due to HM Revenue and Customs on interest that exceeds your Personal Savings Allowance.

** ‘AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

*** Per annum is the estimated total interest based on our gross rates that you will earn over 12 months if you deposit on the day of opening. The estimate also assumes you don’t make any further deposits or withdrawals in 12 months, and interest is paid directly into the account.

View our archived ratesWhy choose an Atom Instant Saver account?

Get ready to save with our Instant Saver. Here’s why you need an easy access savings account in your life:

Set up in minutes

Open your Instant Saver account in-app, in minutes and start saving whenever it suits you.

Easy access to your savings

Enjoy easy access to your savings, 24/7. Withdraw or add money instantly, as many times as you like. You just need to connect a UK current account in your name to get started.

Save at your own pace

With our Instant Saver, there is no minimum or regular deposit required, so you’re free to save at your own pace.

FSCS Protection

What's this all about? Well, in a nutshell your money will be covered by the Financial Services Compensation Scheme (FSCS), which means your deposits are protected up to £85,000 should anything happen to the bank.

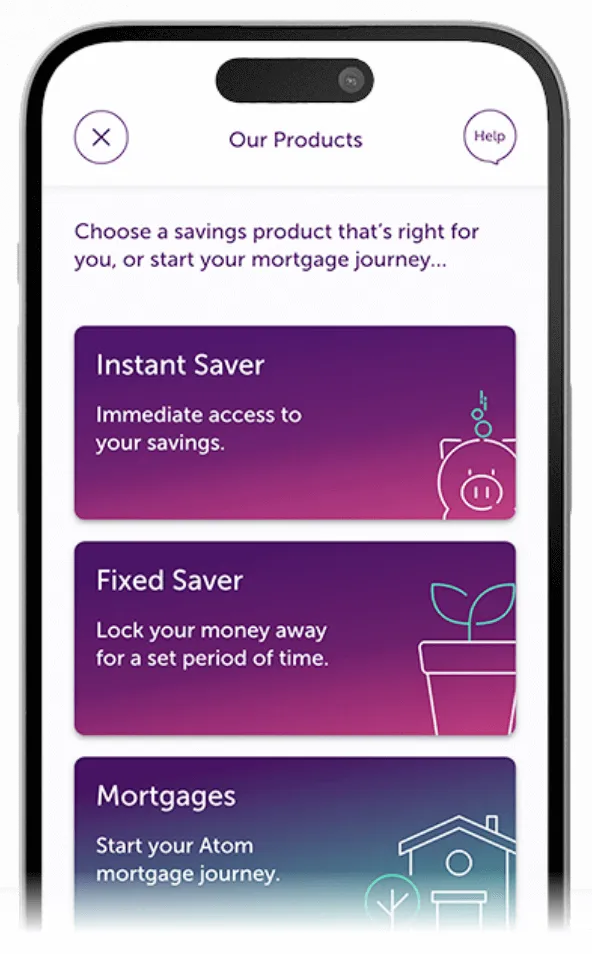

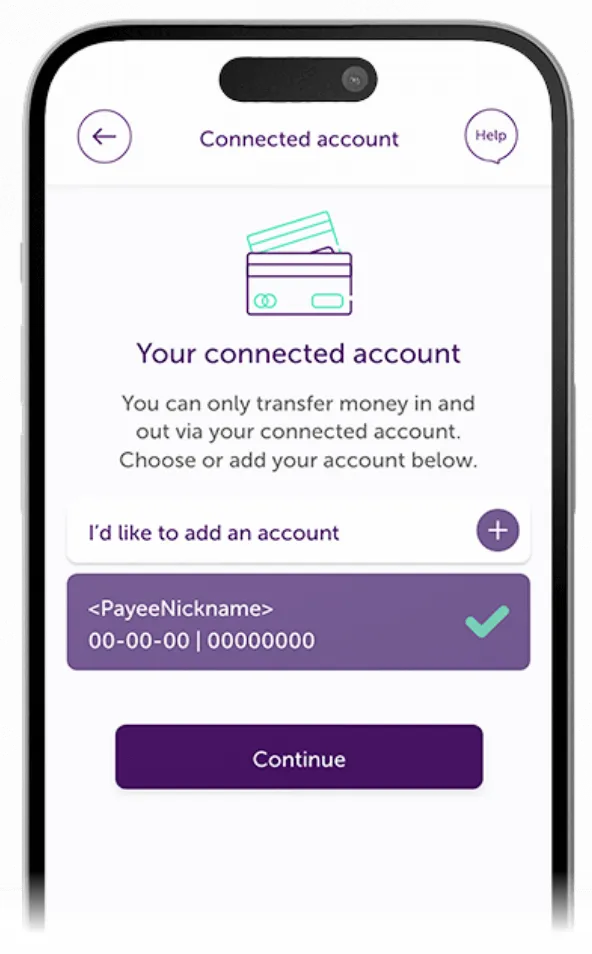

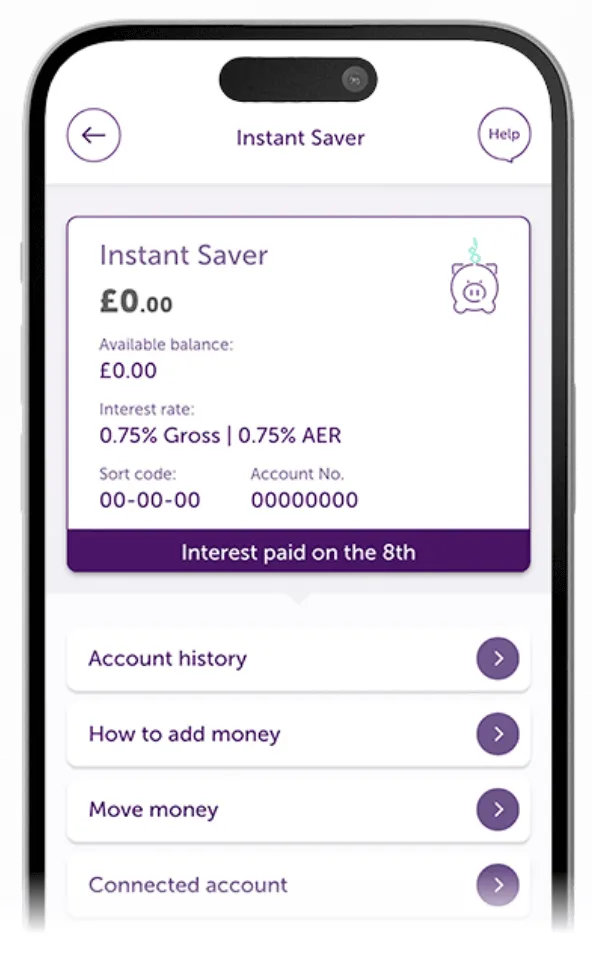

How your Instant Saver account works

The interest rates shown in these images are examples only and may not reflect our current rates.

Instant Saver Summary Box

Account name: Instant Saver

| Interest | Rates |

|---|---|

| Gross per annum | 2.72% (variable) |

| AER | 2.75% (variable) |

- These rates are effective from 08/08/2025.

- You will earn interest on the money in your Instant Saver from the day you pay it into the account. We calculate interest on your balance daily using the gross interest rate and add it to your account once a month, usually on the same date your account was opened.

- ‘AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

- ‘Gross’ is the interest rate paid on an account before any taxes or other deductions are accounted for.

Instant Saver Summary Box_v2.2. Effective from 01/09/2025 (Rates effective from 08/08/2025).

Yeah, but what do customers think?

We use Feefo — an independent review company — to get feedback from real savings customers. It's impartial, honest and well worth a look.

Got a question?

Check out our most popular Instant Saver Frequently Asked Questions below, or kick back and read our Instant Saver T&Cs.

If you want to find out more about Atom bank, head to our FAQs page.

To speak to a member of our team, jump into the app - they're here everyday, 8am to 8pm, ready to help.

Things to remember

Connected account

Link your UK current account (which must be in your name and registered at your address) to your Instant Saver to transfer money in and out of your account whenever you want.

Maximum Balance Limit

You can save up to up to £100,000 across your Atom easy-access accounts at any time (Instant Saver, Instant Saver Reward and/or Holding Accounts).

We'll keep you updated

View your transactions in real-time, know exactly when your statements are ready and forget faffy paperwork — everything’s in the app.

Discover our other savings accounts

Explore some of our other saving products.

Instant Saver Reward

An easy access account that rewards you with a higher rate when you don’t withdraw your money. If you do withdraw, you'll get a lower Withdrawal rate for the current monthly interest period. However, you'll move back to the Reward rate at the start of the next monthly interest period.

Fixed Saver

Secure a competitive rate with our Fixed Saver. Pick a term from 6 months to 5 years and enjoy guaranteed growth for your funds. It’s a good option if you have a lump sum already and won't require immediate access to it.